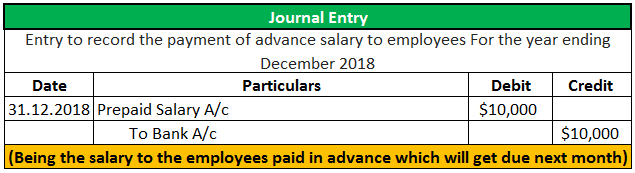

Advances to Employees Journal Entry

The company will debit the current. The life cycle to account for payment of salary expense in cashcheque goes through a couple of steps as shown below.

Payroll Advance To An Employee Journal Entry Double Entry Bookkeeping

Advance to employee or officer employee advance represents a cash payment loan made by the employer for the business expenses that are anticipated to be incurred by the employee or.

. US Legal Forms is a trustworthy resource of more than 85k professional and up-to-date legal templates gathered by states and use cases. This journal entry is made to account for the 5000 cash outflow from our business as well as to recognize our right to receive the 5000 purchased. The amount of Prepaid salary is deducted from salary and shown on the debit side of the profit and loss account.

Professional Fees dr 10000. Journal Entry for Employee Reimbursement Example. On 01 April they should make a journal entry by debiting advance salary and credit cash 12000.

Journal Entry for Advance Received from a Customer. In such circumstances the unearned income. This adjustments if advance funds are made for services or items as a result of be supplied 12 months or more after the cost date.

In certain types of business transactions it is a requirement for the customer to pay a part of the total amount or the entire. Step 1 Journal entry for salary paid in. For example at the beginning of each month Company ABC advances 1000 to its sales manager John Smith for travel-related expenses.

Dec 3rd 2014 at 931 PM. To record the employee advance the. To TDS 500.

It is further shown under the head current asset in the balance. Debit Employee advance account with Open item as Employee id. The process of tracking the LoansAdvances given and recoveries involves the following steps.

The company agrees to lend the employee 800 and to withhold 100 per week from the employees weekly payroll checks until the 800 is repaid. Sanjay Gupta Expert Follow. On 30 April the employees have.

Creating Salary Advance Deduction Pay Head. While expensing out the cash advances Debit all the. Disbursement of salary advances to employees.

Employee Advances Joanne Smith. Advance To Employee Journal Entry. To set up an employee advance the company makes the following journal entry.

Company ABC assigns an employee to a mission in a rural area with a cash advance of 1000 to pay for accommodation and other.

Steps To Adjusting Entries Accounting Education

Prepaid Expenses Journal Entry How To Record Prepaids

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

No comments for "Advances to Employees Journal Entry"

Post a Comment